RRC Polytech key to success for Indigenous banking expert and Business Administration alum

One of the things Tom Thordarson likes best about his longtime career in Indigenous banking is that he is helping his own people.

“Being First Nations myself, I’ve seen the challenges First Nations go through. Anything I can do to help others be successful, that’s my big thing for sure,” he said, sitting at the kitchen table in his West St. Paul home. Thordarson is a member of Peguis First Nation, one of the largest communities of its kind in Manitoba.

One key to his own success was his education in the two-year Business Administration diploma program at RRC Polytech. He graduated in 2005, with an entry-level position at RBC waiting for him.

Today, as a Senior Relationship Manager in Commercial Financial Services for RBC, he specializes in Indigenous Markets with clients in Manitoba and Northwestern Ontario. He understands the First Nations experience and knows how to help people meet their financial goals.

In his role with RBC, he is part of a dedicated Indigenous Markets team with 14 staff across Manitoba, Saskatchewan, Nunavut, and Western Ontario.

“There are a lot of good things happening in First Nation communities right now. So, it’s good to be able to help them,” he said.

“Not all the banks have an Indigenous Markets team like ours; I think RBC was the first to establish one. I appreciate the respect RBC has for First Nations people and communities, and its commitment to truth and reconciliation,” he added.

Thordarson works out of an office in Headingley, on the Swan Lake First Nation Reserve. From there, he empowers First Nation governments and Indigenous clients to navigate a path to grow and succeed, and helps them create future opportunity and prosperity in Manitoba.

His own opportunity came when he was a young man living and working with his father in Peguis First Nation, located 190 kilometers north of Winnipeg.

“There were limited opportunities for employment in Peguis, on the reserve at the time,” he remembered. His father worked in the heating and air conditioning business. “The work in Peguis was sporadic. We’d get busy, and then there were times when we’d have no work. I wanted something more stable.”

That was when he noticed the RBC branch in Peguis had posted a casual teller position. He applied and was hired. Working with numbers always appealed to him ̶ math was his strongest subject in grade school.

RRC Polytech program highly recommended

When it was time for him to leave Peguis First Nation in 2003 to further his education, he knew university didn’t feel right for him. “RRC Polytech seemed like a better fit for me, with it being smaller. That drew me there,” he said.

A cousin of Thordarson’s had taken the Business Administration program at RRC Polytech before him and recommended it. “He had a lot of good things to say about the program, and the different fields you can go into after graduation,” said Thordarson, giving banking and entrepreneurship as examples.

The program taught Thordarson all the aspects of business he needed to know. “Law, accounting – which is helping me to this day, having to get financial statements from my clients and analyzing those – business communications, helping to write proposals, and so on.”

He kept his connections with RBC in between his first and second year, which helped him secure entry to the bank’s Indigenous internship program.

“Over the summer, I went back to work at a branch in Winnipeg,” he said. “After that, RBC offered me a job as a personal loans officer upon graduation. That solidified that I wanted to stay in the banking industry.”

“One of the things that was really good in Business Administration was the second-year entrepreneurship program at the time. Basically, we were put into groups, and we did the work to start up a new business. That includes marketing, financials ̶ everything that goes into getting started. Ours was a health and fitness business,” he remembered.

After working at RBC for about four years, Thordarson’s goal was to get into Indigenous banking. Unfortunately, no such positions were open at the time.

He moved on to jobs with First Nations Bank of Canada, followed by First Peoples Economic Growth Fund Inc., an Indigenous capital corporation. At First Peoples, Thordarson often dealt with First Nations entrepreneurs and startup businesses.

“What I learned at RRC Polytech definitely helped me understand what business owners were going through, and the challenges to get their businesses going. It was rewarding work helping them.”

He still keeps track of his past clients. “Some of the entrepreneurs have become very successful. It is good to see that and to help them get to that point.”

Roughly a decade passed. “RBC kind of kept tabs on me during those years. The Vice-President I work with now approached me on a few occasions and asked if I would be interested in rejoining RBC. We talked and he let me know what I would be doing on the team,” said Thordarson.

Indigenous Markets growing countrywide

Today, Thordarson and RBC’s specialized Indigenous Markets team works closely with First Nations Chiefs and Councils, and their finance people, including accountants and auditors.

“The Indigenous Markets business is growing across Canada. Many of our existing clients are working on projects that require financing with us. RBC has a big market share in Manitoba,” he said.

“Some First Nation governments struggle with their finances,” said Thordarson. “We require annual financial statements from each of our First Nations clients. These documents can be pretty complex. Some of them just don’t have the capacity or the proper staff in place on their finance team to get those done in a timely manner, so that’s an obstacle.”

“But being First Nations myself and having lived on the reserve and seeing the challenges first-hand, I think has helped me to gain the trust of the Chiefs, Councillors, and all the key people that work within the First Nation. Building those relationships takes time, but it pays off,” he explained.

“I will be working with one of the First Nation governments here in Manitoba, and they have different business entities they operate. It could be a development corporation, like an umbrella corporation.”

“So, they could have a gas bar or a grocery store. I look after that relationship and the banking needs of the First Nation government as well. That’s getting the bank accounts open, online access, loans, investments. The whole First Nation banking relationship, basically.”

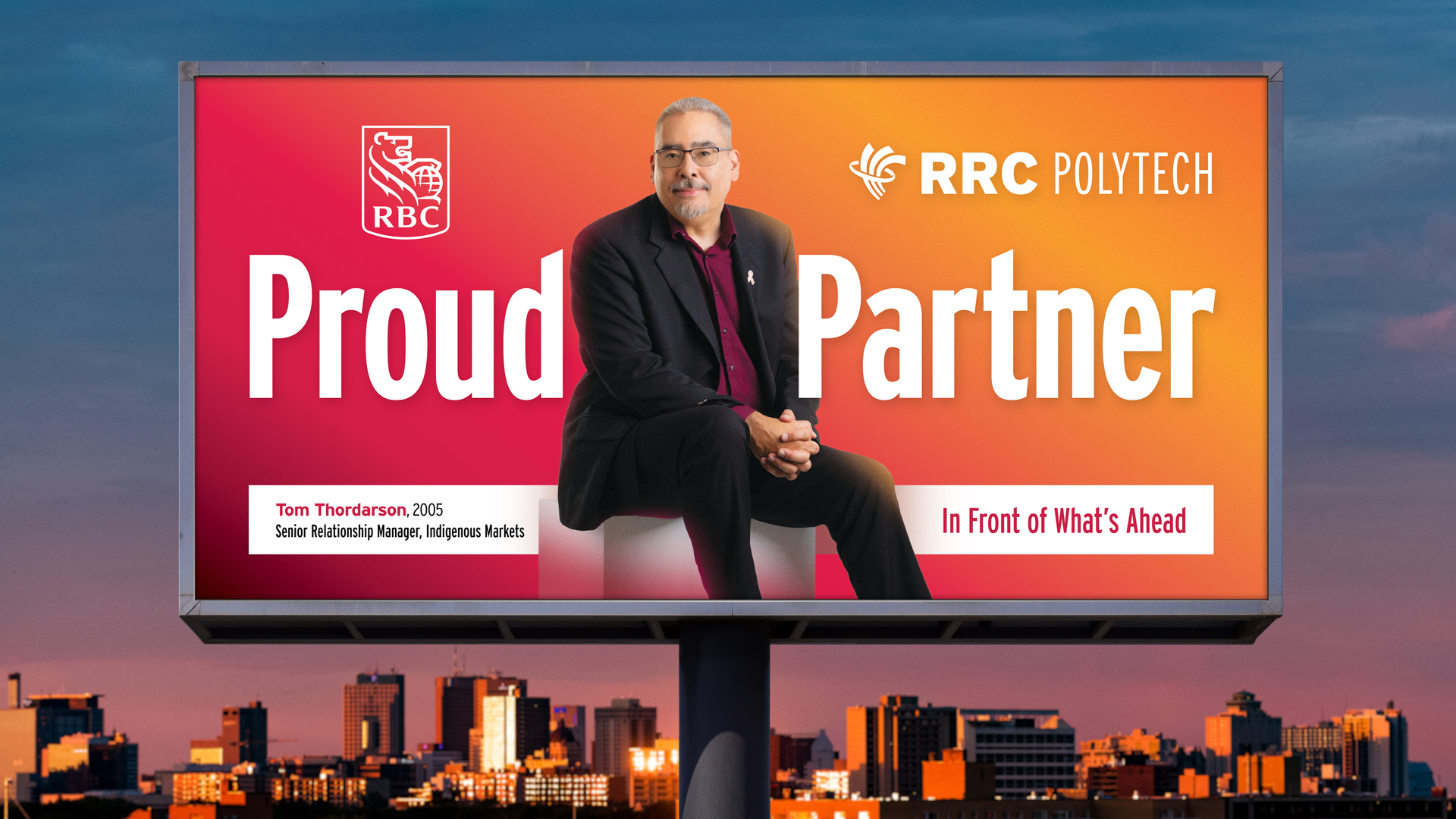

A proud graduate of the College, Thordarson was part of RRC Polytech’s Polytechnic Proud campaign, which featured 41 alumni across programs and generations in billboards in Winnipeg and throughout Manitoba in Spring 2024.

Profile by Nigel Moore (Creative Communications, 1998).